The S&P 500 Index is a benchmark of prominent US companies, and its gains are closely watched by investors worldwide. Sector-specific ETFs offer {aan opportunity to concentrate on specific industries within the S&P 500, allowing for more specific investment strategies.

Investors aiming for to enhance returns or control risk may evaluate sector ETFs as part of their asset allocation. By examining the past results of different sector ETFs, investors can gain knowledge into the likelihood of future returns.

- Healthcare ETFs have been consistently profitable in recent years, but shifts may impact their outlook.

- Energy sectors are often more cyclical to changes in the global economy, presenting both risks for investors.

Recognizing the unique characteristics of each sector and its potential impact on overall portfolio performance is crucial for informed decision-making.

Unlocking Growth Potential: Top Performing S&P 500 Sector ETFs

Seeking to capitalize growth within your portfolio? The S&P 500 offers a abundance of opportunities across diverse sectors. By allocating in sector-specific ETFs, you can focus on areas poised for exceptional performance.

Emerging trends and market shifts constantly reshape the landscape, presenting both challenges and substantial rewards. Top-performing S&P 500 sector ETFs offer a strategic way to steer these fluctuations and harness growth potential.

Consider ETFs that specialize on sectors like technology, healthcare, or energy. These areas are experiencing significant innovation and are extremely likely to generate strong returns in the coming years.

A well-constructed portfolio must diversify across multiple sectors to mitigate uncertainty. By undertaking thorough research and selecting ETFs that correspond your investment goals, you can position yourself for ongoing growth.

Remember, investing involves inherent uncertainties. It's essential to advise with a qualified financial advisor before making any portfolio decisions.

Expanding Your Stock Options

When constructing your S&P 500 portfolio, analyzing sector distribution is crucial. Each sector presents different risks and rewards, allowing you to customize your investments based on your risk tolerance. Explore these top S&P 500 sector ETFs for a well-rounded portfolio:

- Consumer Discretionary's growth potential is undeniable, making ETFs like XLV compelling choices.

- Financials sectors often show volatility, offering higher returns for experienced investors. Consider ETFs like XLE.

- Small-cap stocks can augment your portfolio. Explore ETFs such as VWO.

Keep in mind that diversification is key, and conducting thorough analysis before investing is essential. Consult with a investment professional to create the best sector allocation for your individual needs.

Diversified Investment with S&P 500 Sector ETFs: A Guide for Investors

Navigating the complexities of the stock market can be challenging. Investors seeking to enhance returns while mitigating risk often turn to diversified allocation. Sector investment funds based on the S&P 500 index provide a versatile tool for achieving this goal. By distributing investments across various sectors, investors can harness the ETF market sector performance growth opportunities of different industries.

- Analyzing the performance of each sector is vital for developing a diversified portfolio.

- Examining individual ETFs within each sector allows investors to assess their assets and expenses.

- Adjusting the portfolio periodically ensures that the asset allocation remains consistent with the investor's objectives.

Investment Rotation Techniques Leveraging S&P 500 Sector ETFs for Returns

Navigating the dynamic landscape of the stock market often requires a strategic approach. One such strategy is sector rotation, which entails allocating investments among various sectors of the economy based on their prospects. By utilizing S&P 500 sector ETFs, investors can efficiently implement this tactical approach and potentially enhance returns.

- Furthermore, sector rotation allows investors to exploit the cyclical nature of different industries.

- Consider, during periods of economic expansion, sectors such as consumer discretionary and industrials may excel others. Conversely, in a recessionary environment, defensive sectors like healthcare and utilities might demonstrate stability.

- As a result, by rotating investments between these sectors, investors can potentially mitigate risk and enhance portfolio returns over the long term.

Dabbling in S&P 500 Sector ETFs: Navigating the Risks and Rewards

Diving into the world of exchange-traded funds (ETFs) tied to specific sectors within the S&P 500 can present both alluring opportunities and inherent dangers. This investment vehicles offer a streamlined method to focus on particular industry segments, maybe amplifying returns if that sector performs. Conversely, sector-specific ETFs are inherently volatile, meaning their values can fluctuate sharply based on the fortunes of that individual sector. Prior to venturing into this realm, investors should meticulously analyze their risk tolerance and investment aims.

A well-diversified portfolio remains crucial to mitigating the potential downsides of sector-specific ETFs. Seeking advice from a financial advisor can offer valuable guidance in exploring this complex investment landscape.

Luke Perry Then & Now!

Luke Perry Then & Now! Taran Noah Smith Then & Now!

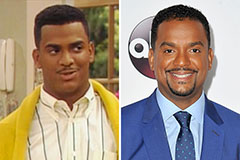

Taran Noah Smith Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!